From July 1, 2020 until December 31, 2020, the value added tax in Germany will be reduced. This is initially primarily a relief for end consumers, but must be taken into account in particular for companies for incoming and outgoing invoices and G/L account postings.

Therefore, there is also a lot to do with your ERP system or store system. We have specialized in setting up odoo and our own offshoot "ITISeasy.business". Here you get tips to teach odoo 16% VAT.

Disclaimer: "This text is neither tax nor legal advice. It is only intended to provide you with tips and advice on what might need to be done in the event of a tax change and, despite careful research, does not claim to be complete or free of errors. If necessary, please consult the tax advisor and legal counsel you trust."

The odoo VAT reduction

You should know

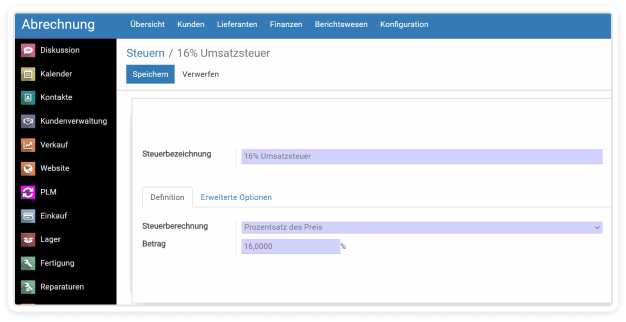

1. The odoo control types

Two additional types of tax must be added to the conventional tax setup: 16% and 5%, for both domestic sales and purchases. Also, do not forget about the EU foreign private sales.

2. Additional accounts in odoo chart of accounts

Other tax accounts in the odoo chart of accounts (In Germany mostly odoo SKR03 or odoo SKR04) must be used to post the taxes.

3. Messages, forms and interfaces

The VAT report and other reports must contain the correct key figures for these postings and be reported correctly. Even with interfaces such as Elster, care must be taken that these serve the tax types. Of course, this also applies to the transfer to DATEV.

4. Please check your receipts

You should test your invoice documents as a draft and also check all the information on a first posted invoice: The tax must be shown correctly there. Do not forget the rest of the receipts that contain tax information.

5. The correctness of the bookings

Check whether the sample invoice from 4. has also been posted correctly, i.e. whether the accounts have been posted correctly.

6. Where does it still say VAT, VAT and VSt everywhere?

This may also need to be adjusted for online stores and other public websites that display VAT.

Our Business Solutions

This might also interest you!

If you have any questions about ongoing projects, or need assistance with problem solving, our project managers and consultants will be happy to help.

Zimbra

An open-source email program for all your needs. Zimbra is not just an open-source mail and groupware solution like any other. But see for yourself what advantages Zimbra brings.

Learn more...

Alfresco - DMS/ECM

Alfresco is a web-based document management system. With it you can manage all your regular and business critical documents. Interesting is also the interface from Odoo to Alfresco to store all important documents.

Odoo

Are you already using an ERP system from Odoo (formerly OpenERP)? Or are you planning to implement a modern, highly integrated and web-based business system in your company instead of your old ERP system?

Do you already know our ITIS Conf for web communication and meetings? Our secure online conference room for communication between you and your employees and customers.

If you have any further questions about our products or are interested in using our virtual conference room, please contact us! We are happy to help you with your challenges.