What’s Changing – A Quick Summary

E-invoicing becomes mandatory from January 1, 2025

No reclaiming of input tax from non-e-invoices

Legal references: § 14 para. 1–3 UStG, § 27 para. 39 UStG, § 33–34 UStDV-E

Applies to all companies in Germany for B2B transactions

Important: A PDF file is not considered a valid e-invoice.

Only structured formats like XRechnung or ZUGFeRD will be accepted.

What’s Changing – A Quick Summary

E-invoicing becomes mandatory from January 1, 2025

No reclaiming of input tax from non-e-invoices

Legal references: § 14 para. 1–3 UStG, § 27 para. 39 UStG, § 33–34 UStDV-E

Applies to all companies in Germany for B2B transactions

Important: A PDF file is not considered a valid e-invoice.

Only structured formats like XRechnung or ZUGFeRD will be accepted.

Explore ITISeasy.business Invoicing Features

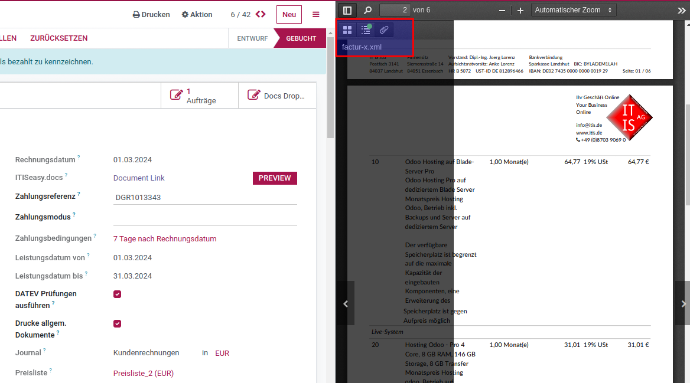

E-Invoicing in ITISeasy.business – Fully Ready in V18

NEW in Version 18

Our e-invoicing tools, introduced in V16, are now enhanced and included at no extra cost in V18:

Automatically reads PDF invoice data

Prevents double entries through intelligent duplicate detection

Accepts & processes multiple incoming invoice formats

Embedded XML support (Factur-X / ZUGFeRD / XRechnung)

Outgoing e-invoices are enriched with XML for legal compliance

Incoming invoice processing for X-invoices is underway

E-Invoicing in ITISeasy.business – Fully Ready in V18

NEW in Version 18

Our e-invoicing tools, introduced in V16, are now enhanced and included at no extra cost in V18:

Automatically reads PDF invoice data

Prevents double entries through intelligent duplicate detection

Accepts & processes multiple incoming invoice formats

Embedded XML support (Factur-X / ZUGFeRD / XRechnung)

Outgoing e-invoices are enriched with XML for legal compliance

Incoming invoice processing for X-invoices is underway

E-Invoicing Workflow Made Simple

E-Invoicing Workflow Made Simple

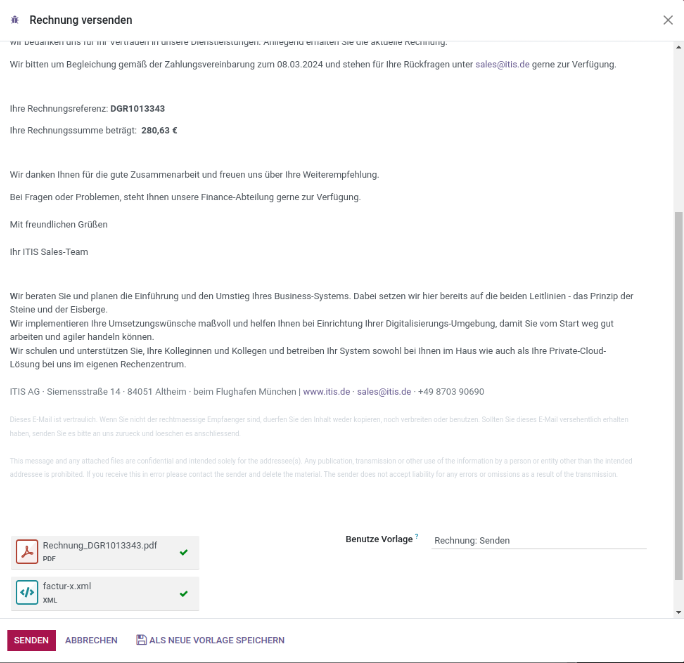

Outgoing Invoices

Create invoices as usual in ITISeasy.business

Use “Send & Print” to include embedded XML

Email is automatically generated from templates

Optional: Attach separate XML file alongside PDF

Formats supported:

ZUGFeRD 2.2 / Factur-X 1.0

XRechnung

Outgoing Invoices

Create invoices as usual in ITISeasy.business

Use “Send & Print” to include embedded XML

Email is automatically generated from templates

Optional: Attach separate XML file alongside PDF

Outgoing e-invoices are enriched with XML for legal compliance

Incoming invoice processing for X-invoices is underway

Formats supported:

ZUGFeRD 2.2 / Factur-X 1.0

XRechnung

Incoming Invoices (Coming Soon)

Multi-format support for incoming invoices

Automatic data extraction

Integration with supplier records

Smart alerts for duplicates and discrepancies

Incoming Invoices (Coming Soon)

Multi-format support for incoming invoices

Automatic data extraction

Integration with supplier records

Smart alerts for duplicates and discrepancies

Good to Know: What Is (and Isn't) an E-Invoice?

NOT an E-Invoice:

PDF, Word, or scanned documents

Valid E-Invoice:

Machine-readable XML formats like

XRechnung (Germany)

ZUGFeRD / Factur-X (Germany & France)

Good to Know: What Is (and Isn't) an E-Invoice?

NOT an E-Invoice:

PDF, Word, or scanned documents

Valid E-Invoice:

Machine-readable XML formats like

XRechnung (Germany)

ZUGFeRD / Factur-X (Germany & France

We've Been Ready Since Odoo V8

Our e-invoicing expertise runs deep.

We developed our first ZUGFeRD-compliant module for Odoo 8 – long before many ERP vendors even considered the feature.

Full support for embedded XML

Legally compliant format generation

Real-time document validation

We've Been Ready Since Odoo V8

Our e-invoicing expertise runs deep.

We developed our first ZUGFeRD-compliant module for Odoo 8 – long before many ERP vendors even considered the feature.

Full support for embedded XML

Legally compliant format generation

Real-time document validation

What You Should Do Now

If you’re not using ITISeasy.business yet:

We’ll help you switch and become e-invoice ready before 2025.

Already using ITISeasy.business?

Let’s review your current configuration and ensure full readiness for 2025.

What You Should Do Now

If you’re not using ITISeasy.business yet:

We’ll help you switch and become e-invoice ready before 2025.

Already using ITISeasy.business?

Let’s review your current configuration and ensure full readiness for 2025.

Book a Free Consultation

“We’ll show you how easy e-invoicing can be – fully compliant and future-proof.”

Fill out the form below, and we’ll get in touch:

ITIS AG – Your E-Invoicing Implementation Partner

We don’t just offer software — we deliver:

Compliance with EU & German legal standards

End-to-end e-invoicing strategy

Expert support team

Integration with existing processes

Combine it with ITISeasy.email for end-to-end automation.

ITIS AG – Your E-Invoicing Implementation Partner

We don’t just offer software — we deliver:

Compliance with EU & German legal standards

End-to-end e-invoicing strategy

Expert support team

Integration with existing processes

Combine it with ITISeasy.email for end-to-end automation.

Don’t Wait —

Be E-Invoice Ready Today!

Germany’s e-invoicing mandate is around the corner.

ITISeasy.business makes the transition seamless, secure, and smart.

Don’t Wait —

Be E-Invoice Ready Today!

Germany’s e-invoicing mandate is around the corner.

ITISeasy.business makes the transition seamless, secure, and smart.

Request a Demo

Download Our E-Invoicing Guide

Get in Touch Now