Employee Payroll with ITISeasy.business

Create your employee payrolls quick and easy

The Payroll

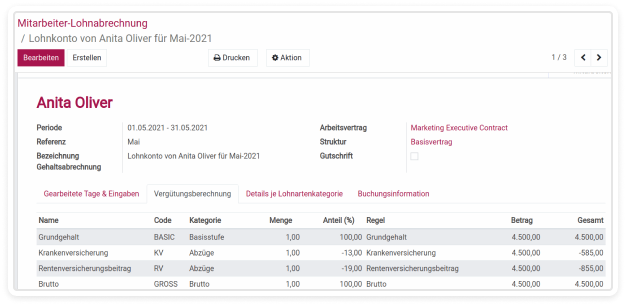

The payroll process with ITISeasy.business must be carried out independently for each employee to accommodate individual factors such as salary or affiliation (church tax).

Using the example of employee Mrs. Oliver, health insurance and pension contributions were deducted from the gross salary.

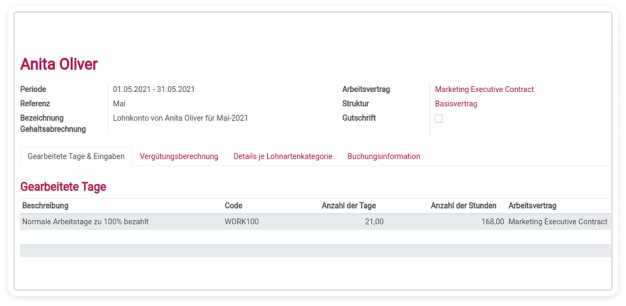

The interconnected accounting becomes evident here, as the number of days worked during the specified period of May is directly transferred from the attendance record. Also to be included in the payroll are the employment contract and the payroll account structure as described later.

The Employment Contract

The employee's employment contract includes not only the typical details such as weekly hours, vacation entitlement, and monthly compensation, but also the compensation structure (here: base contract) that outlines how the compensation calculation is structured.

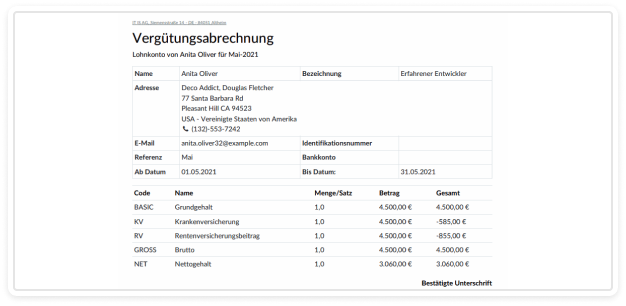

PDF Reports

The employee's payroll can be presented and printed as a PDF file. This clearly shows how the net salary is calculated and what deductions are applied.

The payroll calculation can also be more comprehensive, including additional information about wage categories and social contributions.

Payroll Configuration

Configuration

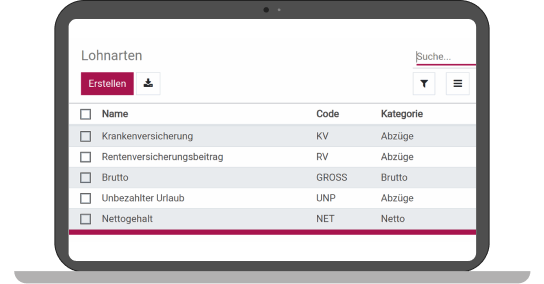

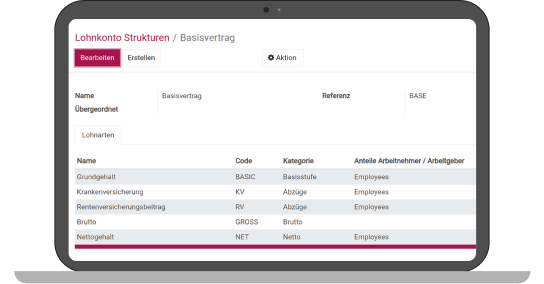

The various wage types, wage category types (deductions, net, gross), as well as the payroll account structure, need to be set up in the configuration area.

Payroll Account Structure

The various wage types, wage category types (deductions, net, gross), as well as the payroll account structure, need to be set up in the configuration area.

You Need Further Details about ITISeasy.business?

Contact us for more information or a Demo.